Congratulations! You’re at such an exciting point in your business journey, you’re considering hiring your first employee! It’s the first step to expanding your business and can be a daunting one.

When you take someone on, there are lots of factors that you may not have considered. The structure of your business is about to take a dramatic shift. You don’t just have yourself to think about and organise now!

First, I want to cover when NOT to hire your first employee, just a quick exercise to get you really thinking about whether you’re on track, or perhaps getting a bit ahead of yourself.

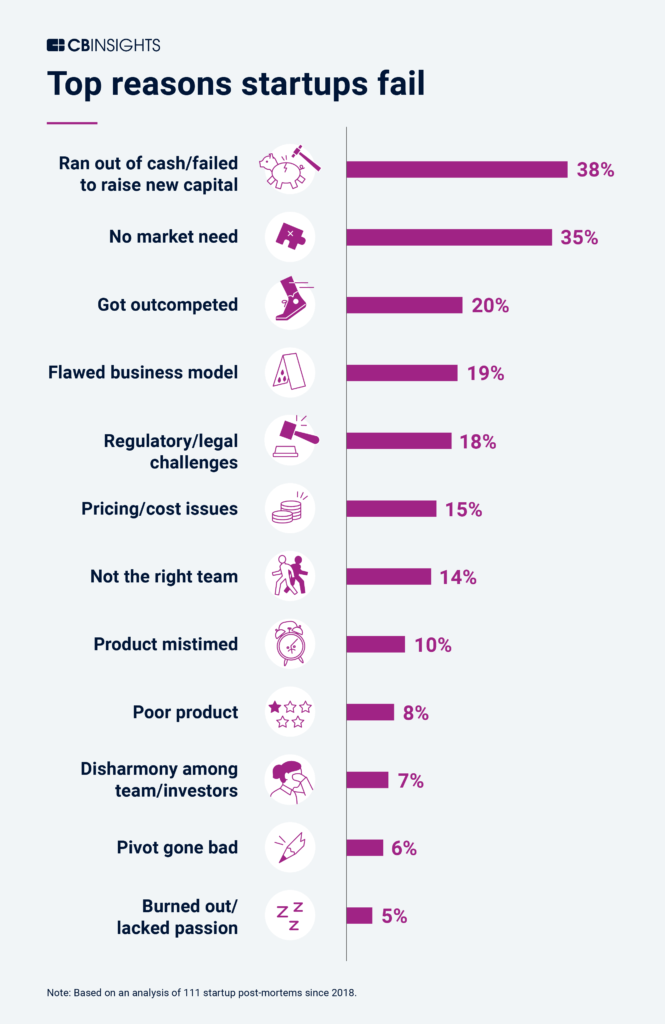

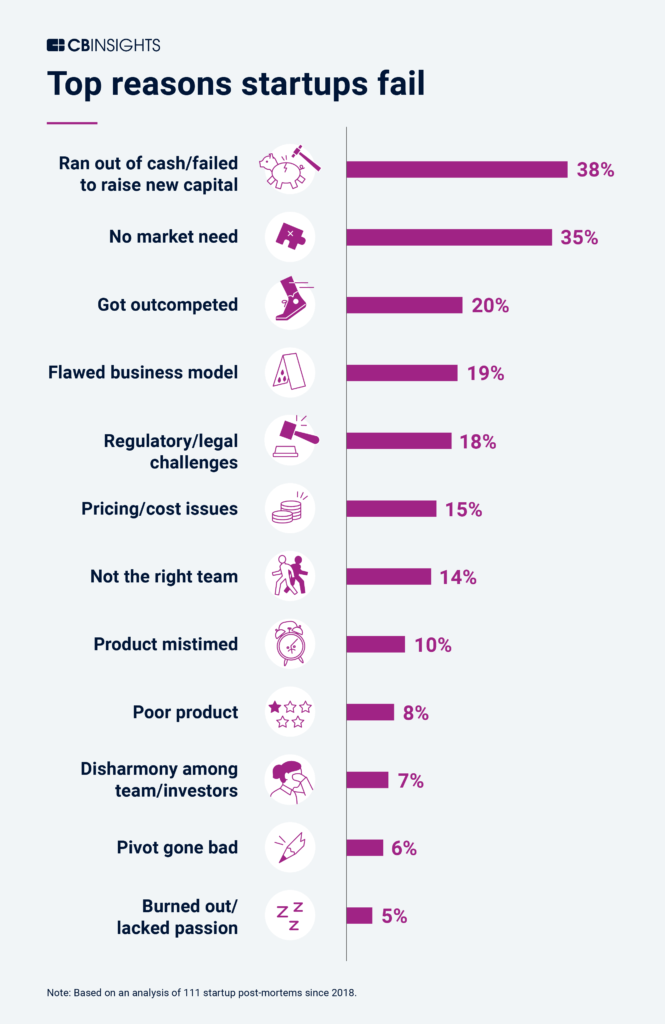

Taking someone on too early can cause huge problems for you and your business. One of the top reasons for business failure is lack of cash flow and I’m sure you know that employees cost money. Therefore they’re going to have a direct impact on your bottom line.

Don’t be tempted to hire someone because you’re busy and desperate for help. Desperate, irrational decisions are rarely the right ones. Taking on someone with a limited cash flow is dangerous.

Have a plan!

Don’t hire without a plan. Figure out exactly what part they will play in your business. Get a job description together, think ahead to where you’d like to be and plan out your entire team map, their roles, responsibilities and renumeration packages. From here, you can figure out who is most important to you right now and who you need to hire first. Once you have a list of job roles and respective responsibilities, do you even have enough work at this stage for your potential first employee? Can you afford to hire them right now, or do you need more time? Don’t be tempted to hire the cheapest employee on your list if they’re going to bring little to the table in terms of business growth.

Think carefully about the type of person you want on your team.

If you take another look at that list, another problem is having the wrong team. Not only do you need to make sure your business can support an employee, hiring the right person is just as important. This isn’t necessarily the most qualified, if you can afford to train someone up, you’d be much better to find someone with potential, that really fits the personality of your business and has the qualities you’re looking for. Skills can be taught, innate personality cannot.

Hiring on a whim is likely to cause problems further on down the line, especially if there are blurred lines between responsibilities or your new employee simply isn’t the right fit. Take your time. Think it through. Have a plan.

So, with that out the way, if you’re still keen to move forward. That’s great! Let’s turn our attention to what is involved in hiring your first employee.

Recruitment

Just simply recruiting a member of staff can be costly. Papers typically charge more for employment ads than they do any other form of advertising, and if you’re tempted to get the help of a recruitment agency, they can take up to 20% of the first year of salary of your new employee as payment.

There are cheaper or even free methods, however:

Harness the power of social media.

Facebook or LinkedIn provide excellent platforms for advertising your position and on Facebook especially, news of available work travels fast. Whilst on LinkedIn, you can browse through profiles that are ‘open to new opportunities’ and invite them to chat if you think they’d be a great fit.

Don’t forget that there is a minefield of laws encompassing recruitment, especially with regards to equal opportunities. The ACAS website is an invaluable source of information.

Salary

The largest cost of a new employee is their salary. You can mitigate the impact by starting out with a part-time member of staff but it can be difficult to find the correct person that is willing to work part time, or have the flexibility to allow their hours to grow as the business grows.

Starting someone on a fixed term contract can be a great way to test the waters with the intention of making them a permanent member of your team if it all goes well but by using this strategy, you may find it difficult to find that perfect fit.

Don’t forget, whatever route you take, your new employee will expect their salary in full, on time, every month. You have a duty to ensure that this is the case. If work goes quiet, you are the one that takes the financial hit, not your employee.

Now would be a great time to look at your last 12 months of work and see if you can project the next 12 months – it should give you a good indication on whether you can afford to commit yourself to someone else’s livelihood.

Employment Contract

As of April 2020, your new employee must receive their written contract on the first day of work. Failure to provide this can leave you open to a tribunal claim. A contract sets out important statutory information, such as renumeration, holiday entitlement, sickness policy amongst other things. You may wish to get someone to help you draw this up to ensure that it includes everything that is legally required and is suited to the circumstances of your business, this could be an HR company or freelancer or solicitor. Becoming a member of the FSB, provides a fantastic library of contract templates, letters, policies, and procedures as well as up to date guidance on the latest laws and regulations and access to their legal team for support. I highly recommend it!

National Insurance and Income Tax

As the employer, it is your responsibility to ensure that income tax and NI is paid for your new employee. There are penalties for not complying. You must make the correct deductions each month and pay employers NI contributions on top.

Employers must pay Class 1 NICs of 13.8% (correct at time of writing) on all earnings above the secondary threshold for almost all employees and this is set to increase by 1.5% from April 2022. This means employers NICs will increase to 15.3% on all earnings above the secondary threshold for most employees.

https://www.gov.uk/national-insurance-rates-letters#content

At this point, it is well worth considering the payroll services of an accountant or bookkeeper. It is relatively inexpensive and will ensure that you comply with the law and allow you to focus on other, important aspects of your business.

Check out this really handy payroll calculator

Pensions

Under the Pensions Act 2008, It is now compulsory that all eligible employees are ‘automatically enrolled’ onto a pension scheme and that you contribute towards it. You are legally obliged from the moment you take on your first employee.

Head over to the pensions regulator for extra information and support. If you chose to engage with an accountant, this is also something that they can help you with.

Employers Liability Insurance

From the moment your first employee starts work, it is essential to have employers liability insurance which covers you if your employee injures themselves or falls ill as a result of working for you. Fines for not having the correct insurance in place are immense – up to £2,500 per day!

You may also wish to look into legal cover in the event that your employee brings a claim against you, such as unfair dismissal.

Sickness, maternity and flexible working

Employees have a lot of rights. You will have to pay them at least the minimum wage, you will need to pay them when they are off sick, on holiday or if they have a baby. The right to flexible working came into force in 2014 so it’s important that you gen up on the latest regulations to ensure you stay operating within the law and don’t inadvertently land yourself in an employment tribunal.

Not only that but how will you cope with employee absence? How will it affect your business? Can you get cover? Make sure you have a plan as absences will be par for the course.

Premises

A lovely advantage of being a sole trader is having the ability to work from home. But when thinking about hiring your first employee, that might no longer be viable. You may not want others working at your dining table with you, or you may struggle to get the proper insurances on a domestic property.

To keep things manageable, consider looking at renting a small office in a local, serviced business centre where your bills will be predictable.

Time

Perhaps the biggest drain hiring your first employee will have is on your time. They come with a mountain of paperwork, you’ll need policies and procedures in place, they will need initial training and just how much that entails will be down to the individual you take on and how much experience they have.

Don’t skimp on the policies and procedures – they will give both you and your employee guidelines for how to handle certain situations and will ensure that, as you grow, everyone is treated equally and knows where they stand.

So that’s it. This is by no means an exhaustive list but hopefully provides some food for thought as you take that leap into becoming an employer. Remember though, no-one will be as committed to your business as you are. They don’t have as much to gain, or lose, from the performance of your business. Look after them though, the happier your staff are, the more loyal and committed they will be which will reflect in the service your customers receive.

Got something you want me to write about – contact me and let me know!